September 27, 2023

The first time I took note of Edward H. Harriman, owner of the Union Pacific Railroad, was in Butch Cassidy and the Sundance Kid (Newman, Redford 1969), by a line from the wimpy-looking fellow ostensibly guarding the safe on the train. The bespectacled railroad employee refers to his personal obligation to Mr. Harriman to protect the payroll shipment.

This may be the scene where Robert Redford sardonically criticizes Paul Newman: “Use enough dynamite there, Butch?” Which has been dryly repeated probably millions of times (including by me) in reference to some event of overkill.

What has caught my eye about Harriman is his ambition, enormous energy and proclivity for risk-taking.

The Gilded Age

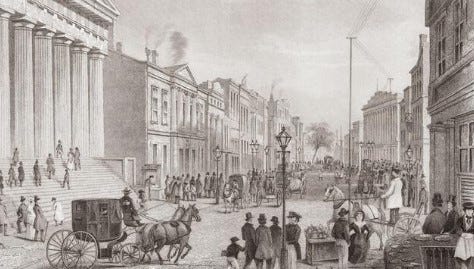

Harriman is a representative of America’s Gilded Age, that period roughly from post-Civil War to the turn of the century, 1877-1900. All the really cool stuff happened then: Big oil, big steel, big rail, big cattle, telegraph, telephone, Wall Street, labor unrest, the Wild West, blatant political corruption.

In this history we find tutors for us today. Productive living in the 21st century is rooted in lessons of the 19th.

A Titan Ascends

Harriman disdained formal education and left school at 14 to work on Wall Street as a messenger boy. Before electronic communications, buy-sell orders for stock trading were physically carried between brokerage houses on slips of paper by hand. As a “pad shover,” the young man gained a reputation for dependability and for an astonishing memory.

At 22, he borrowed $5,000 (an enormous fortune) to purchase a seat on the New York Stock Exchange.

At 33, he purchased the the broken-down and unprofitable Lake Ontario Southern Railroad, repaired it, renamed it, and sold it two years later to the Pennsylvania Railroad at a profit. This launched a career flipping railway lines as some today flip houses.

At 35, he took a seat on the board of the Illinois Central.

At 39, he was appointed president of the Union Pacific.

Unstoppable Focus

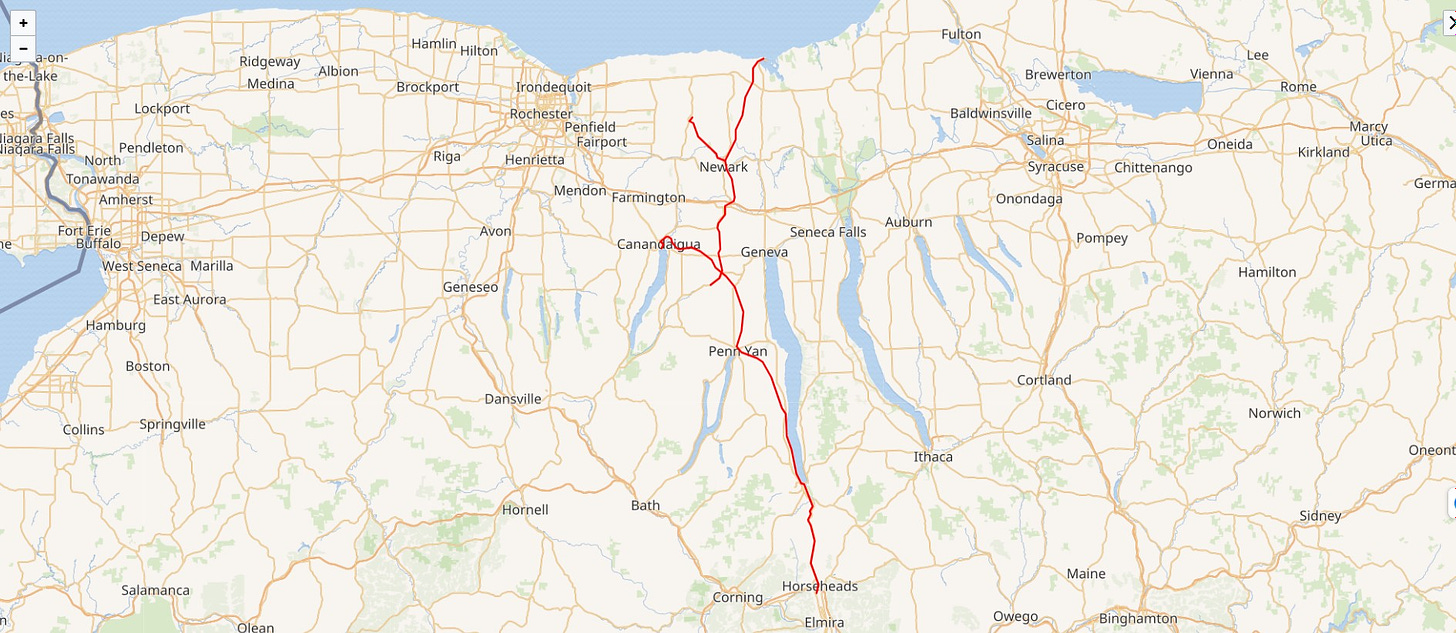

At 50, as a director of the Union Pacific, he put his incredible attention to detail to good use. He traveled from the Missouri River to the Pacific Ocean on a special car, personally inspecting every car, every track, every tie, bolt and spike, every station. His list of repairs cost $25 million and made the UP a model of efficiency and safety.

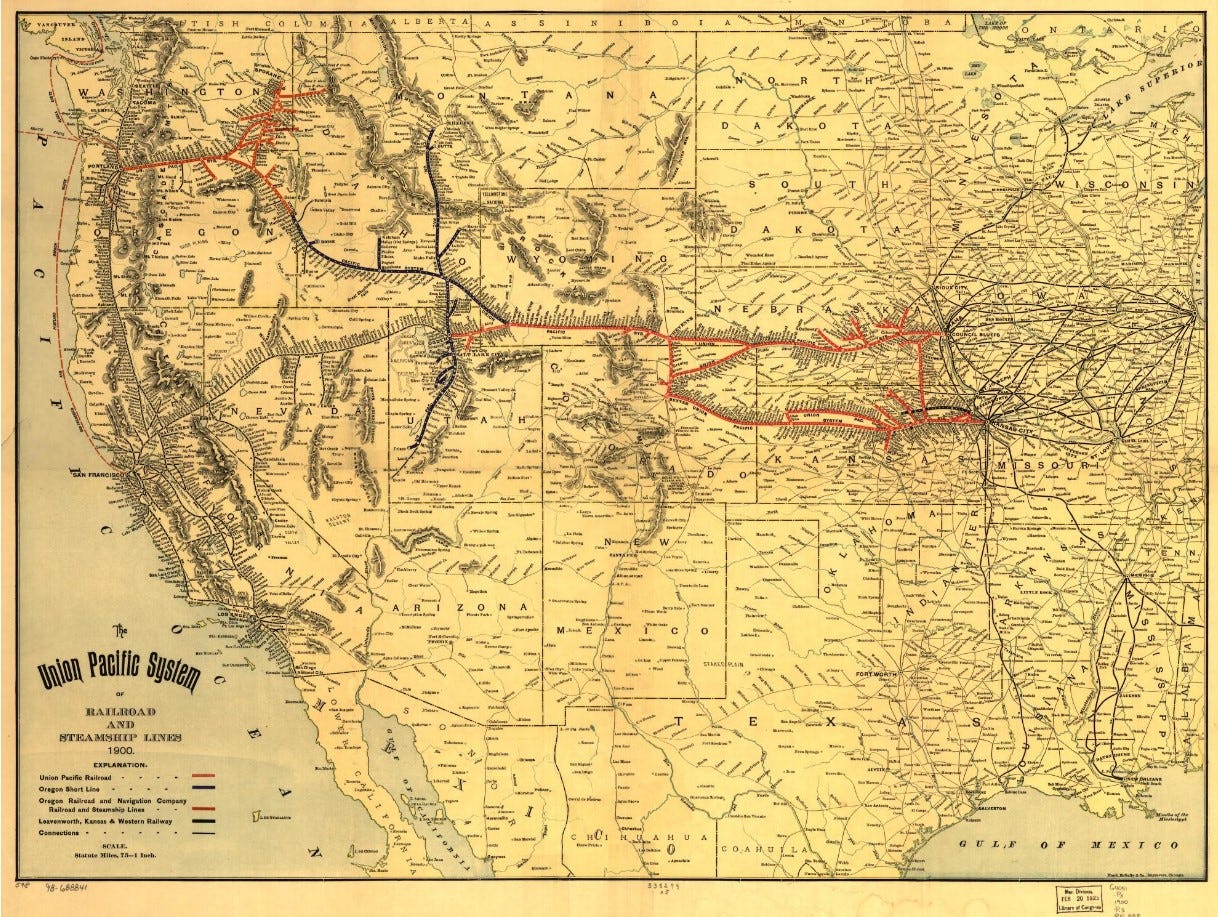

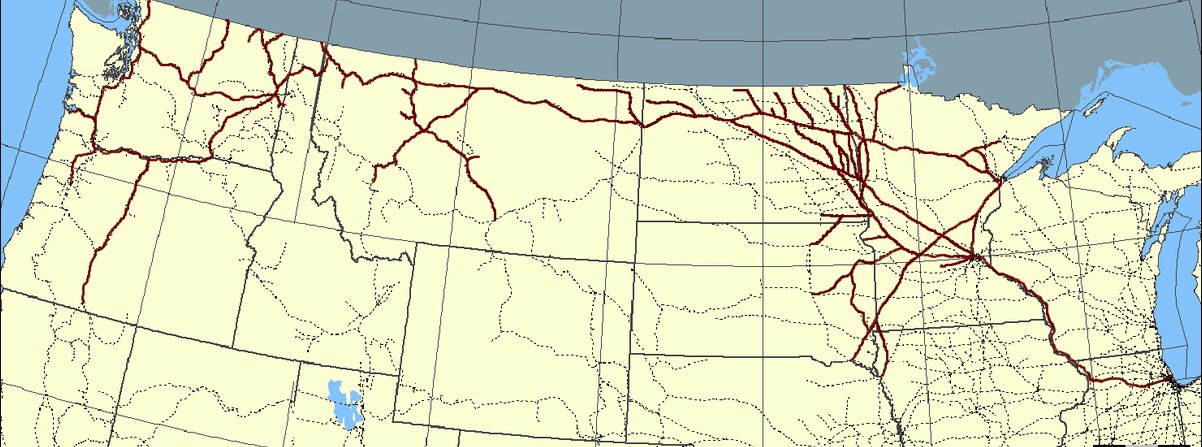

At 53, Harriman saw the potential to control the freight railway business all the way from Chicago to Seattle. Expanding the UP on this route would give him access not only to the east-west freight, but also to cotton exported from southern states to the Far East through ports in the northwest.

To accomplish this, he needed control of the Great Northern and the Northern Pacific, both owned by James J. Hill. He set his sights thus.

But first, let’s go to Alaska.

Alaska

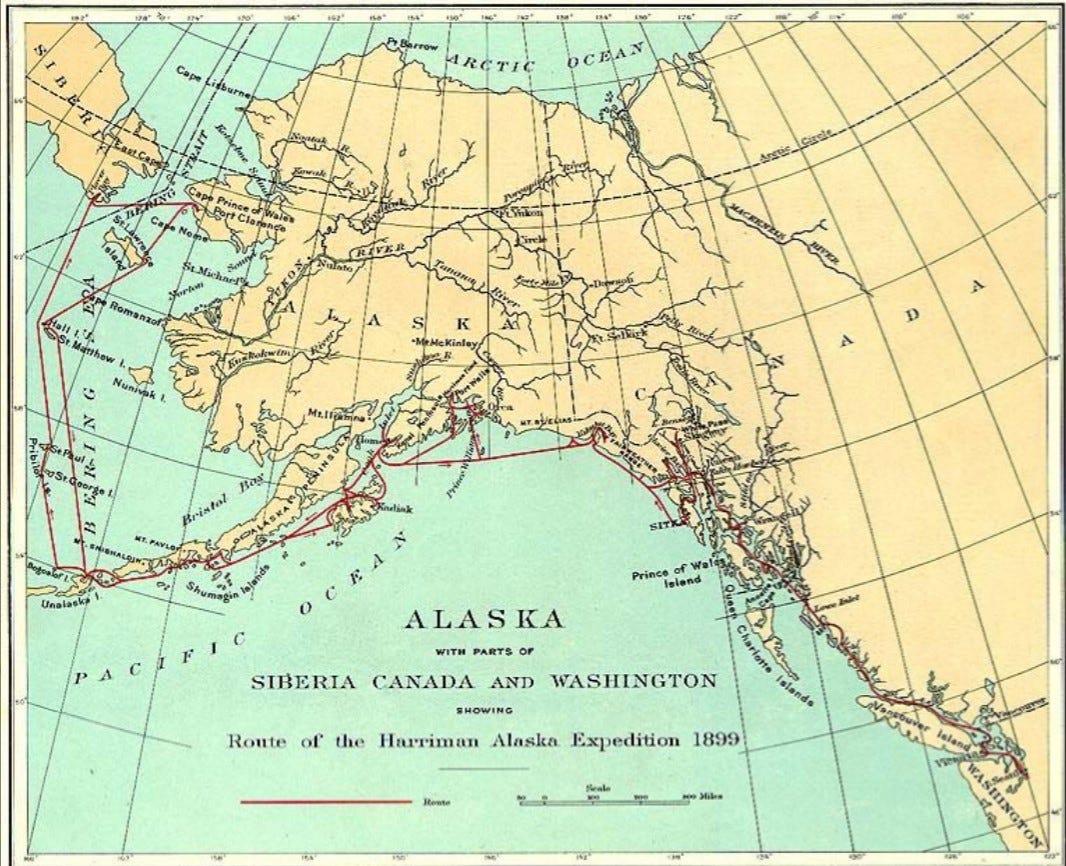

Harriman is perhaps best known for his working vacation to Alaska in 1899. Counselled by doctors to take a break from business affairs after his exhausting Union Pacific duties, he slated a two-month excursion to Alaska involving 126 passengers on the steamship George W. Elder.

In the 9,000 mile trip they stopped 50 times for shore excursions so that eminent guests could document the flora and fauna never before recorded. On-board experts included C. Hart Merriam (biologist), John Burroughs (nature journalist), John Muir (naturalist), Charles Augusta Keeler (natural history), George Bird Grinnell (nature editor) and Edward Curtis (photographer — 5,000 pictures).

Harriman shared an affinity for nature with Teddy Roosevelt, including the desire to shoot a grizzly bear. Harriman took two on this trip.

I marvel at the notion that Harriman’s choice to relax, a year after his grueling and exhausting personal review of Union Pacific repairs, was to lead an expedition documenting the heretofore unexplored British Columbia-to-Alaska coastline.

Harriman’s energy was unstoppable, and probably led to his early death at age 62.

The Money Game

Once this time of comparative rest and relaxation was over, Harriman was anxious to get back to real work. He had his sights set on the northern route from Chicago to Seattle, and in his customary shrewd manner set about to take what he wanted.

His target was the Northern Pacific Railroad, owned by James J. Hill.

James J. Hill was financially backed by J. P. Morgan, the New York king of money. Harriman was backed by Jacob Schiff, second only to Morgan in the American financial world.

Harriman and Schiff began quietly buying Northern Pacific stock, seeking control. Hill and Morgan controlled only 23% of their railroad stock. When they discovered Harriman’s plot, they also began buying. Both parties were seeking majority ownership positions, and the race was on.

I don’t have the space to go into this in detail here, but the story of the Harriman-Hill stock battle is worth a Hollywood movie. It is complete with payment deadlines, enormous financial losses, international telegrams and frenetic buy/sell orders fueled by berserk egos.

It was the Panic of 1901, the first-ever stock market collapse of the NYSE.

As Harriman bid up the price of the stock, most expected the value to fall again and so sold short.

Shorting a stock is betting that its price will fall. The strategy is to borrow share certificates (in those days, actual paper) that you do not own, and put them up for sale.

For example, say the value of the stock is $100. You find someone who already owns shares and borrow the certificates from him; you must return the shares to him after a brief period, say one week. You sell the shares you just borrowed (which you did not really own), and hold the $100 cash.

When the next day the price falls, you buy back the shares (which, again, you did not ever really own) at, say $50, then return those share certificates to the original owner in time to meet your repayment deadline.

During these transactions you have not actually ever owned those shares, but you have just pocketed $50 profit, less transaction fees. You can make fabulous wealth overnight with no money down — if the stock price behaves the way you expect.

However, in short selling, there is no limit to your risk. If you borrow the stock at $100, and the price rises instead of falls, you must then purchase the certificates (in order to return them to the original owner by the loan deadline) at the new higher price, say $200, and you have just lost $100.

It was a high-stakes game played with millions of dollars in frantic stock trades. In the space of 3 days in May 1901, the price of Northern Pacific shot up from $160 to $1,000 per share.

Thousands of small investors were ruined. Read about it in this article, linked in the blog.

The price eventually fell back to a reasonable level, but not soon enough for those who had sold short.

The bubble had burst, as bubbles do; Harriman lost millions, failed in his bid for the Northern Pacific, and began to recede from the big money game. Not that he was destitute; by the time of his death in 1909 his estate was valued in excess of $200 million.

Trust Busting

Hill and Morgan, with their deeper pockets, had retained control of the Northern Pacific and built their own Chicago-to-Seattle route. They formed the Northern Securities Company to hold the stock.

Morgan had backed Teddy Roosevelt in his unsuccessful bid for the presidency in 1900. Then, in a uniquely American Gilded Age twist, Roosevelt’s administration brought suit against Morgan’s Northern Securities under the Sherman Anti-Trust Act.

In 1904 the trust was dismantled through a Supreme Court decision. The rail line remained in operation in various disassociated parts.

In spite of this seeming loss, the “House of Morgan” continued its alliance with President Roosevelt, most notably bailing out the federal government with a $10 million loan of gold bullion to avert the Panic of 1907.

Entanglements and inconsistencies abounded. Cash was always king, and the more cash, the more risk. Furthermore, I suspect there was more to the Morgan-Roosevelt story than this, but chasing that will have to wait.

Without doubt, Edward H. Harriman was an American Titan. Like those of his ilk, he donated fortunes to charities, and he had it to give. We can — and should — challenge his unstinting desire for the Almighty Dollar, but we can also draw from him a zeal for success. Even in defeat, he played the game with all his heart.

Theological Contemplations

Colossians 3:23-24 Whatever you do, work at it with all your heart, as working for the Lord, not for human masters, since you know that you will receive an inheritance from the Lord as a reward. It is the Lord Christ you are serving.

When considering Biblical principles, such as that penned by Paul in this epistle, it is best to consider the entire passage rather than just the parts we like.

Edward Harriman did indeed work at his railroad business with all his heart and thus showed us the path to the first half of this passage: Whatever you do, work at it with all your heart…

It is unclear, however, whether he had any focus on the second half, serving the Lord Christ.

While Harriman excelled at the first one, the Apostle urges us to do both of them. Whether that leads to a $200 million estate is in God’s hands. For most of us, that’s a long shot.

But the journey is the thing, and regardless of the money, the reward of the “inheritance from the Lord” awaits at the end.

We would do well to work with all our heart, in the context of serving the Lord Christ.

And a Subscription Reminder

Thanks for reading The Alligator Blog. Our audience is growing all the time. If you are not already a subscriber, you may sign up for free, and we will send these blogs and podcasts directly to your inbox on a regular schedule.

If you believe The Alligator Blog has value – and really, who could not believe that? – then please click through the Subscribe or Upgrade button to make yours an annual subscription. It’s discounted 15% from the regular month-to-month rate, down to only $50 a year… about the price of a deluxe coffee each month. And The Alligator Blog is probably better for your health.

To help you with that decision, once you sign up for the annual subscription, we will email you instructions for your free merch: Either the paperback book Alligator Wrestling in the Cancer Ward, signed by the author, or the Pants-on ceramic Alligator Wrestling coffee mug, or the Alligator Wrestling Spirit Wine Tumbler. Your gift is free with our appreciation, and we will ship it either to you, or to the recipient of your choice.

That’s all for now! Curt

Share this post